E-Invoicing

Struggling With E-Invoice Preparation?

Solving the Top E-Invoicing Challenges Faced by Modern Businesses

Struggling with System Integration?

Elevate Your Invoicing to Real-Time Precision.

Worried About Security?

OUR E-INVOICING SERVICES

Providing Efficiency & Integration for Every Business

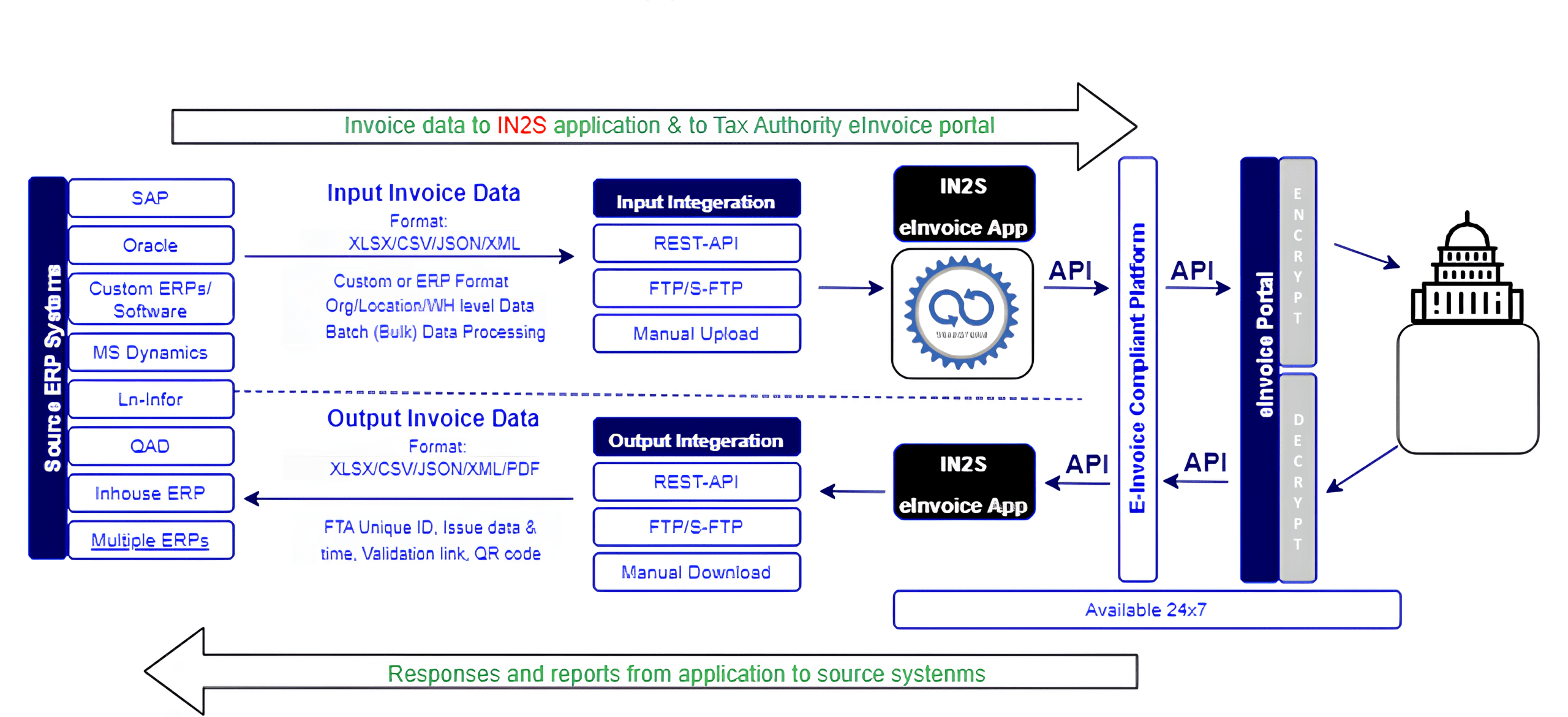

Multi-ERP Integration

Connects seamlessly with leading ERP systems like Oracle, SAP, Microsoft Dynamics, and custom ERPs, enabling businesses to send and receive e-invoices without major system changes.

Middleware-Driven Integration

End-to-end integration via robust middleware solutions Open to collaboration with any middleware or 3rd party providers

Real-Time Invoice Validation

Enables near real-time verification of invoices with the tax authority portal, reducing errors, rejections, and ensuring immediate compliance feedback.

Secure Digital Archiving

Invoices are securely encrypted, validated, and stored digitally with audit trails, QR codes, and FTA-compliant metadata for long-term retrieval and compliance.

Advanced API Integration

Provides robust REST API and FTP/SFTP integration methods for both input and output data, ensuring smooth, secure, and automated data exchange.

Data Mapping & Custom Workflow Automation

Supports mapping of custom invoice fields, automation of specific business workflows, and optimization of performance to meet unique enterprise needs.

Flexible Deployment (Cloud / On-Prem / SaaS)

Supports multiple hosting models—cloud (SaaS), on-premises, or private server—giving businesses flexibility based on budget, control, and scalability needs.

Automated Invoice Generation & Error Handling

Automatically generates e-invoices in XML, JSON, or PDF formats, performs data validation, and provides error messages and correction workflows.

Scalable & Cost-Effective Solution

Supports high invoice volumes with scalable architecture and tiered pricing, adaptable to business size and growth with minimal disruption.

Serving Businesses, Consumers & Governments

B2B Transactions

Optimize invoice exchange between companies with fast, secure, and compliant B2B e-invoicing—ensuring accuracy and transparency across your ERP systems.

B2C Transactions

Enhance customer experience with automated B2C invoicing that supports secure payments, instant validation, and clear digital records for every transaction.

B2G Transactions

Meet regulatory expectations for Business-to-Government invoicing through secure, real-time submission and storage—ideal for public sector compliance.

IMPLEMENTATION TIMELINE

Q4 2024

Development of SPs, Accreditation Requirements and Procedures.

Development of the UAE Data Dictionary.

Q2 2025

E-Invoicing Legislation

Q2 2026

Phase 1 go-live of

E-Invoicing reporting

Our Solution

e-Invoice App and a compliance platform to the tax authorities' digital portal. This ensures proper formatting and encrypted transmission for regulatory compliance. The system also manages return communication, delivering confirmations and reports back to your originating systems for an efficient

e-invoicing process.